Allowances and benefits

In addition to the basic salary, Agents may receive various allowances depending on their personal circumstances. The final salary is calculated by adding the relevant allowances and by deducting social security contributions and other taxes.

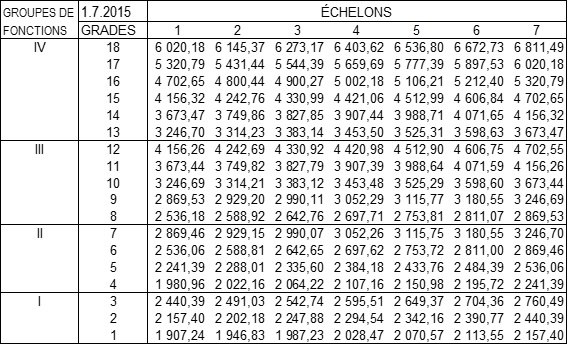

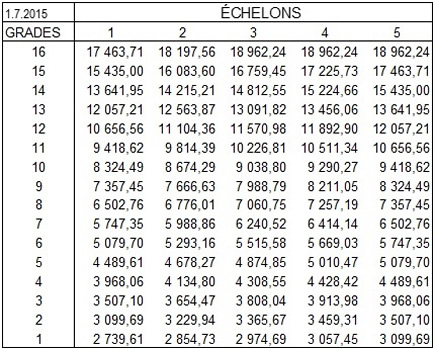

Each grade is broken up into several seniority steps with corresponding salary increases. Basic salaries are adjusted annually in line with inflation and purchasing power in the EU countries. To reflect the higher or lower cost of living in Dublin compared with Brussels, the basic salary is weighted by applying a coefficient based on the cost of living in Ireland (2016 coefficient for Ireland is 116.6% compared with Brussels 100%). Detailed salary tables for Officials, Temporary Agents and Contract Agents are set out below.

The main benefits, deductions and contributions are summarised below. This information is indicative as entitlements are determined upon recruitment.

Family allowances

Head of household allowance - Basic amount of €176.01, plus 2% of basic salary (value as of 01.01.2016)

- Dependent child allowance - Per month and per dependent child: €384.60 (value as of 01.01.2016)

- Education allowances:

- Pre-school allowance €93.95 per month and per child (value as of 01.01.2016)

- Education allowance up to a maximum of €260.95 (value on 01.01.2016) per month for each dependent child, which can be doubled in some cases.

Other allowances

Agents may be entitled to:

- Expatriation allowance (equal to 16% of the total of the basic salary) or a foreign-residence allowance (equal to 4% of the total basic salary), depending on nationality and time spent in the place of employment

- Installation allowance: Between one third of basic salary and two full basic salaries, depending on contract duration and personal circumstances

- Daily subsistence allowance: Fixed amounts of €40.43 per day or €32.59 per day, depending on whether the Agent is entitled to the household allowance or not.

For Agents not receiving the household allowance, the daily subsistence allowance is granted up to 120 days.

For Agents receiving the household allowance, the daily subsistence allowance is granted for 180 days. As a probationer, the daily subsistence allowance is granted for the period of probation plus one month.

- Removal and travel expenses: Agents with contract duration of at least twelve months are entitled to reimbursement of removal expenses up to the amount of a quotation approved in advance. On taking up duties, Agents are entitled to reimbursement of travel expenses from the place of recruitment to the place of employment.

Similar allowances such as resettlement allowance may be granted upon end of service.

Deductions

Deductions

Salaries and allowances paid by Eurofound are exempt from any national taxation in all EU Member States, but subject to a European tax (deducted at source) for the benefit of the European Communities.

Social security contributions (% of basic salary)

- Pension (10.1%)

- Health insurance (1.70%)

- Accident cover (0.10%)

- Unemployment insurance (0.81%)

Income tax

- Tax levied progressively at a rate of between 8% and 45% of the taxable portion of the salary

- Special levy (6%) calculated on the part of the remuneration exceeding the minimum remuneration

Sickness and accident insurance, health

Eurofound staff members are covered, 24/7 and worldwide, by the EU Joint Sickness Insurance Scheme (JSIS). A staff member's family may also be covered under this insurance scheme.

Before commencement of duties, new staff members are required to undergo a pre-employment medical examination. In addition, Eurofound staff members undergo an annual fitness for work medical check-up.

Pension

Throughout the period of service, Agents are members of the EU pension scheme. The pension is granted after completing a minimum of ten years' service and reaching the pensionable age of 66 years. Pension rights acquired in one or more national schemes before starting to work at Eurofound may be transferred into the EU pension system.

Leave and absences

A standard working week at Eurofound is 40 hours.

Eurofound staff members are entitled to annual leave of 24 working days plus Eurofound holidays (normally 17 days per annum), which to a large extent correspond to Irish national holidays. On top of this entitlement, additional leave days are granted for age, grade and distance from the place of origin within the EU. Special leave is granted for certain circumstances such as marriage, birth or adoption of a child, death of a close relative, etc.

Salary overview

Basic salary table for Officials and Temporary Agents.

Basic salary table for Contract Agents.