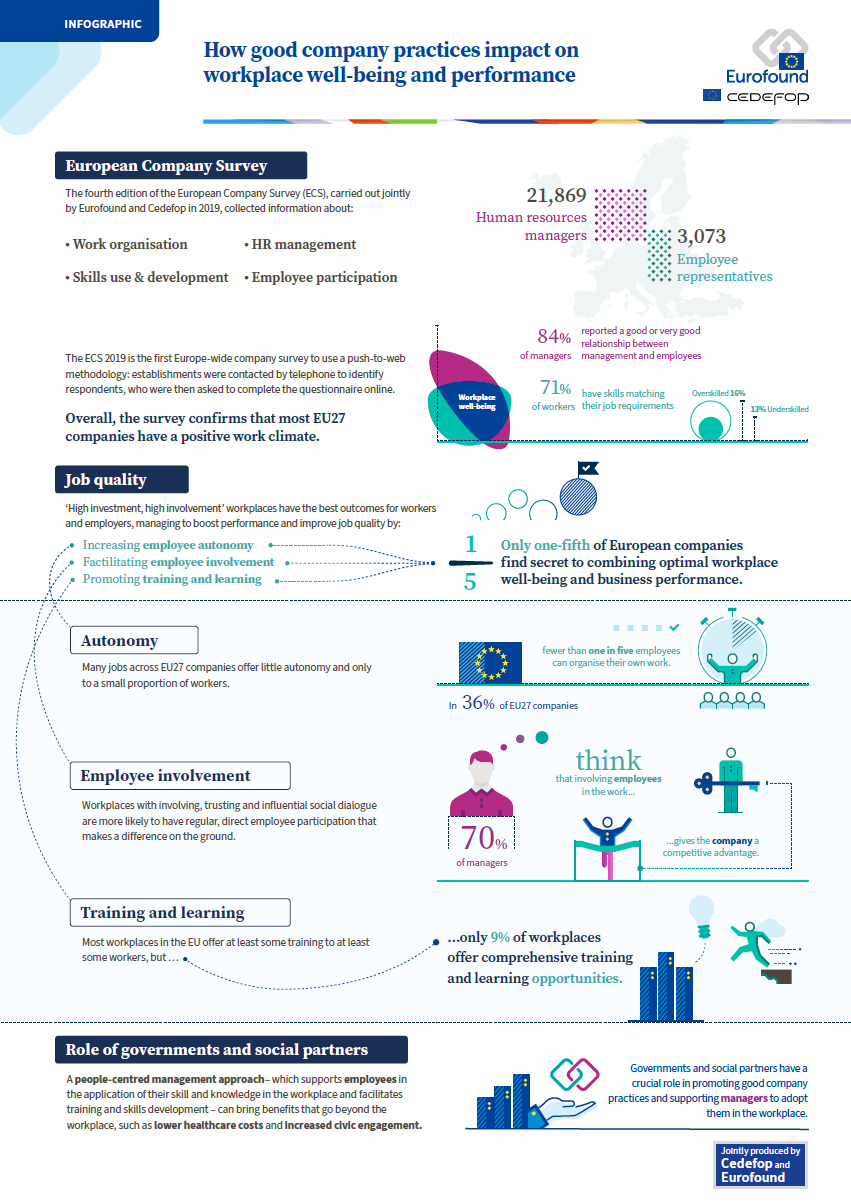

Der vorliegende Bericht beruht auf der vierten Ausgabe der Europäischen Unternehmenserhebung (ECS), die 2019 gemeinsam von Eurofound und Cedefop durchgeführt wurde. Darin wird ein breit gefächertes Spektrum von Praktiken und Strategien in Bezug auf Arbeitsorganisation, Personalmanagement, Nutzung und Entwicklung von Kompetenzen und Beteiligung von Arbeitnehmern beschrieben, die von europäischen Unternehmen umgesetzt werden. In dem Bericht wird aufgezeigt, wie diese Praktiken miteinander kombiniert werden und wie diese „gebündelten Praktiken“ mit zwei Auswirkungen gekoppelt werden können, die für Arbeitnehmer und Arbeitgeber gleichermaßen von Vorteil sind, nämlich Wohlbefinden am Arbeitsplatz und betriebliche Leistung.

Die Analyse ergibt, dass diejenigen Betriebe, bei denen die Wahrscheinlichkeit, dass sie dieses Win-Win-Ergebnis erzielen, am höchsten ist, diejenigen sind, die ein hohes Maß an Eigenverantwortung der Arbeitnehmer, eine ausgewogene Motivationsstrategie, eine umfassende Fortbildungs- und Lernstrategie und einen hohen Grad an unmittelbarer Beteiligung der Arbeitnehmer an der Entscheidungsfindung miteinander kombinieren und außerdem Unterstützung für diese Praktiken durch die Geschäftsleitung anbieten. Zur Förderung der Übernahme mitarbeiterorientierter Praktiken – insbesondere in Bezug auf Eigenverantwortung, Kompetenzen und Arbeitnehmerbeteiligung – sollte Führungskräften entsprechende Unterstützung angeboten werden, da sie eine entscheidende Rolle bei der Entscheidung, Änderungen im Arbeitsumfeld einzuleiten, spielen. Sie sind aber auch für deren Erfolg maßgeblich, da sie die umgesetzten betrieblichen Praktiken fortlaufend unterstützen müssen.

Key findings

Die ECS 2019 zeigt, dass Unternehmen ihre betrieblichen Praktiken so gestalten können, dass Auswirkungen erzielt werden, die sowohl Arbeitnehmern als auch Arbeitgebern zugutekommen. Unternehmen können die Leistung steigern und zugleich bestimmte Aspekte der Arbeitsplatzqualität verbessern, indem sie Praktiken bündeln, die die Eigenverantwortung der Mitarbeiter stärken, deren Mitsprache erleichtern und Fortbildung und Lernen fördern.

In rund einem Fünftel der Betriebe in der EU gibt es solche gebündelten nutzbringenden Praktiken. Gelungene Beispiele sind in allen Arten von Unternehmen zu finden, unabhängig von Land, Größe, Wirtschaftszweig oder Wettbewerbsstrategie.

Die erfolgreichsten Firmen haben nicht nur Praktiken eingeführt, die diesem Ziel förderlich sind, sondern verfügen auch über eine Geschäftsleitung, die sie diesbezüglich unterstützt.

Fortbildung ist eine wichtige Möglichkeit, positive Auswirkungen am Arbeitsplatz zu erzielen. Die meisten Betriebe in der EU bieten zumindest ein gewisses Maß an Fortbildung für zumindest einige Arbeitnehmer an, doch nur wenige stellen ihnen ein umfassendes Fortbildungs- und Lernangebot zur Verfügung.

Unternehmen mit einem starken betrieblichen sozialen Dialog schneiden im Hinblick auf Leistung und Wohlbefinden besser ab. In Betrieben mit einem beteiligungsorientierten, vertrauensvollen und gewichtigen sozialen Dialog ist auch die Wahrscheinlichkeit höher, dass die Arbeitnehmer regelmäßig und unmittelbar beteiligt werden, was in der Praxis viel bewirken kann.

Data visualisation

Visualise, explore and compare EU and country data from the European Company Survey (ECS) 2019 in our interactive data visualisation tool.

Infographic

List of tables

The ECS 2019 overview report has the following list of tables.

Table 1: Relations between management and employees as described by the management and employee representative respondents (%)

Table 2: Profiles of establishment types – digitalisation (%)

Table 3: Profiles of establishment types – job complexity and autonomy (%)

Table 4: Profiles of establishment types – recruitment (%)

Table 5: Profiles of establishment types – workplace behaviour and motivational levers (%)

Table 6: Involvement of the employee representative in negotiations for various pay types (%)

Table 7: Profiles of establishment types – variable pay (%)

Table 8: Profiles of establishment types – training and skills development (%)

Table 9: Profiles of establishment types – direct employee participation (%)

Table 10: Profiles of establishment types – social dialogue (%)

Table 11: Profiles of the four groups of establishments (%)

Table A1: Language versions created and translation approach used

Table A2: Target and completed sample sizes

Table A3: Employee representative types and sampling rules, by country

List of figures

The ECS 2019 overview report has the following list of figures.

Figure 1: Conceptual framework for the analysis of ECS 2019

Figure 2: Workplace well-being and establishment performance, by establishment type – job complexity and autonomy (z-scores)

Figure 3: Types of establishment, by size (%)

Figure 4: Sector of economic activity, by country (%)

Figure 5: Years in operation, by establishment size (%)

Figure 6: Prevalence of three human resources challenges, by establishment size (%)

Figure 7: Profitability and profit expectation in 2018 (%)

Figure 8: Change in production volume and expected employment growth (%)

Figure 9: Workplace well-being and establishment performance, by country (z-scores)

Figure 10: Workplace well-being and establishment performance, by sector and establishment size (z-scores)

Figure 11: Establishment type – digitalisation, by country (%)

Figure 12: Establishment type – digitalisation, by sector and establishment size (%)

Figure 13: Workplace well-being and establishment performance, by establishment type – digitalisation (z-scores)

Figure 14: Levels of innovation, by country (%)

Figure 15: Introduction of innovation to the establishment and to the market, by sector and establishment size (%)

Figure 16: Workplace well-being and establishment performance, by establishment type – innovation (z-scores)

Figure 17: Degree of product market competition, by country (%)

Figure 18: Degree of demand predictability, by country (%)

Figure 19: Dominant product market strategy, by country (%)

Figure 20: Dominant product market strategy, by sector (%)

Figure 21: Market competitiveness, by dominant product market strategy (%)

Figure 22: Workplace well-being and establishment performance, by establishment type – product market strategy (z-scores)

Figure 23: Collaboration and outsourcing according to activity, by sector (%)

Figure 24: Collaboration and outsourcing, by country (%)

Figure 25: Collaboration and outsourcing, by sector and establishment size and type (%)

Figure 26: Workplace well-being and establishment performance, by establishment type – collaboration and outsourcing (z-scores)

Figure 27: Forms of teamwork, by sector and establishment size (%)

Figure 28: Establishment type – job complexity and autonomy, by country (%)

Figure 29: Workplace well-being and establishment performance, by establishment type – job complexity and autonomy (z-scores)

Figure 30: Establishment type – job complexity and autonomy, by digitalisation, innovation and product market strategy (%)

Figure 31: Proportion of employees with a fixed-term contract, by country (%)

Figure 32: Proportion of employees with a fixed-term contract, by sector and establishment size (%)

Figure 33: Workplace well-being and establishment performance, by proportion of employees with a fixed-term contract (z-scores)

Figure 34: Proportion of employees with a part-time contract, by country (%)

Figure 35: Proportion of employees with a part-time contract, by sector and establishment size (%)

Figure 36: Workplace well-being and establishment performance, by proportion of employees with a part-time contract (z-scores)

Figure 37: Establishment type – recruitment, by country (%)

Figure 38: Establishment type – recruitment, by sector and establishment size (%)

Figure 39: Workplace well-being and establishment performance, by establishment type – recruitment (z-scores)

Figure 40: Establishment type – recruitment, by digitalisation, innovation and product market strategy (%)

Figure 41: Importance of discretionary helping behaviour, by country (%)

Figure 42: Importance of willingness to stay longer when the work requires it, by country (%)

Figure 43: Importance of making suggestions for improvements, by country (%)

Figure 44: Proportion of establishments using different motivational levers, by frequency of use (%)

Figure 45: Establishment type – workplace behaviour and motivational levers, by country (%)

Figure 46: Establishment type – workplace behaviour and motivational levers, by sector and establishment size (%)

Figure 47: Workplace well-being and establishment performance, by establishment type – workplace behaviour and motivational levers (z-scores)

Figure 48: Establishment type – workplace behaviour and motivational levers, by digitalisation, innovation and product market strategy (%)

Figure 49: Establishment type – variable pay, by country (%)

Figure 50: Establishment type – variable pay, by sector and establishment size (%)

Figure 51: Workplace well-being and establishment performance, by establishment type – variable pay (z-scores)

Figure 52: Establishment type – variable pay, by digitalisation, innovation and product market strategy (%)

Figure 53: Skills match of employees, by country (%)

Figure 54: Speed of change in skills requirements, by country (%)

Figure 55: Proportion of employees in jobs requiring continuous training, by country (%)

Figure 56: Proportion of employees in jobs offering limited learning opportunities, by country (%)

Figure 57: Dominant skills development strategy, by country (%)

Figure 58: Proportion of employees who received training during paid working time, by country (%)

Figure 59: Proportion of employees who received on-the-job training, by country (%)

Figure 60: Involvement of the employee representatives in matters concerning training (%)

Figure 61: Perceived importance of training, by country (%)

Figure 62: Establishment type – training and skills development, by country (%)

Figure 63: Establishment type – training and skills development, by sector and establishment size (%)

Figure 64: Workplace well-being and establishment performance, by establishment type – training and skills development (z-scores)

Figure 65: Establishment type – training and skills development, by digitalisation, innovation and product market strategy (%)

Figure 66: Prevalence of tools for engaging with employees and their frequency of use (%)

Figure 67: Areas of employee influence on management decisions, by extent of influence (%)

Figure 68: Establishment type – direct employee participation, by country (%)

Figure 69: Establishment type – direct employee participation, by sector and establishment size (%)

Figure 70: Workplace well-being and establishment performance, by establishment type – direct employee participation (z-scores)

Figure 71: Establishment type – direct employee participation, by digitalisation, innovation and product market strategy (%)

Figure 72: Presence of official structures for employee representation, by country and establishment size (%)

Figure 73: Configurations of employee representation structures (%)

Figure 74: Establishments with employee and employer representation, by country (%)

Figure 75: Establishments where the wages of any employees were set by collective bargaining, by country (%)

Figure 76: Opinions of employee representatives about management (%)

Figure 77: Level of influence of the employee representative on management decisions (%)

Figure 78: Establishment type – social dialogue, by country (%)

Figure 79: Establishment type – social dialogue, by sector and establishment size (%)

Figure 80: Workplace well-being and establishment performance, by establishment type – social dialogue (z-scores)

Figure 81: Establishment type – social dialogue, by digitalisation, innovation and product market strategy (%)

Figure 82: Establishment type – social dialogue, by establishment type – direct participation (%)

Figure 83: Groups of establishments, by country (%)

Figure 84: Groups of establishments, by sector and establishment size (%)

Figure 85: Workplace well-being and establishment performance, by establishment group (z-scores)

Figure 86: Relative workplace well-being and establishment performance within each establishment group (%)

Figure 87: Groups of establishments, by digitalisation, innovation and product market strategy (%)

Figure A1 shows the rates for all countries in the survey

Figure A2: Screener success rate (contact details obtained), conversion rate and overall yield rate – employee representative respondents (%)

Customised reports

To show appreciation for the time the ECS 2019 management respondents invested in filling out the questionnaire, Eurofound and Cedefop offered to generate a customised report for their establishment.

The reports are generated automatically, and compare the establishment with other establishments in the same country, size category and sector. They include information on market characteristics, product market strategy, innovation, establishment performance, workplace relations, and human resources challenges.

Over 13,000 respondents requested to receive such a customised report. Upon finalisation of the dataset the at the end of 2019, the reports were generated, and they were distributed to respondents in the beginning of 2020.

- Number of pages

-

180

- Reference nº

-

EF20001

- ISBN

-

978-92-897-2107-3

- Catalogue nº

-

TJ-03-20-568-EN-N

- DOI

-

10.2806/763770

- Permalink

Reader-friendly versions of the source questionnaires are available:

- ECS 2019: Management interview (pdf)

- ECS 2019: Employee representative interview (pdf)

Language versions

- ECS 2019: Questionnaire language versions